Bizuno is the one stop solution for your business

Fast and secure and feature rich, PhreeSoft and Bizuno may be the only business application you will need.

Anchored by the remarkable power and stability of the PhreeBooks accounting engine, Bizuno adds

CRM, Inventory Management, Production Control, Credit Card Processing, Bank account Management and Quality Control Solutions.

Small Business Solutions In one place

Host your site in the PhreeSoft cloud. Fast and secure, our servers are lightly loaded to deliver fast page generation. Plus it's automatically integrated with the Bizuno ERP application. It's like having you own IT team.

Available in Basic and Pro feature levels, Bizuno is hosted by PhreeSoft in their fast and secure cloud. Have access to your companies ERP system wherever you are. For small business that don't need the power and features, Basic is surprisingly feature rich. Pro will bring your business to levels you never thought possible.

Fast and secure, and no prying eyes. PhreeSoft's email hosting provides generous storage for you businesses communications. All accessible via your favorite SMTP or IMAP mail client.

Up-to-date Sales tax calculations for every zip code ing the United States, fully integrated into your WordPress site and Bizuno Pro ERP solutions. It just happens. Reports to quickly segregate your data and pay the states those nasty taxes.

Bizuno is fully integrated with Carriers such as FedEX, UPS and the US Postal Service. Validate addresses, shop shipping rates and print labels, all at a touch of a button.

Fresh ideas

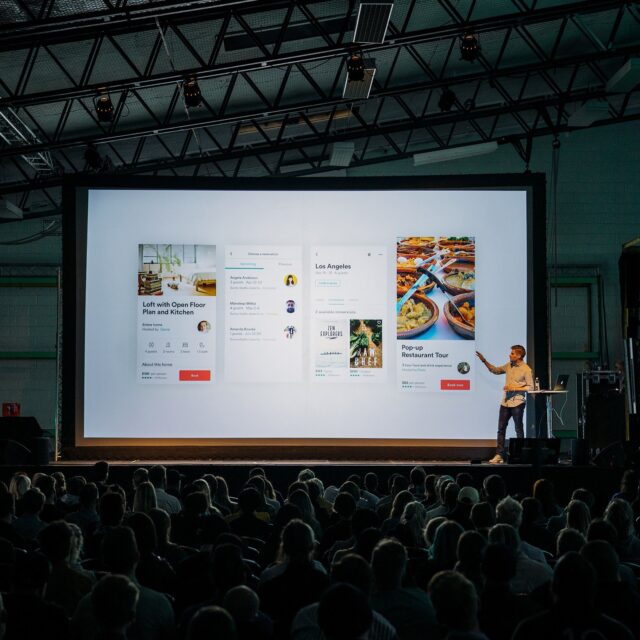

Conferences

Fresh ideas

Trainings

Fresh ideas

Meetings

Fresh ideas

Trade Shows

Fresh ideas

Festivals

Fresh ideas

Galas

Fresh ideas

WebinarsWe love our clients